The Impact of the Bank of Canada's 50 Basis Point Rate Cut on the Economy and Commercial Real Estate

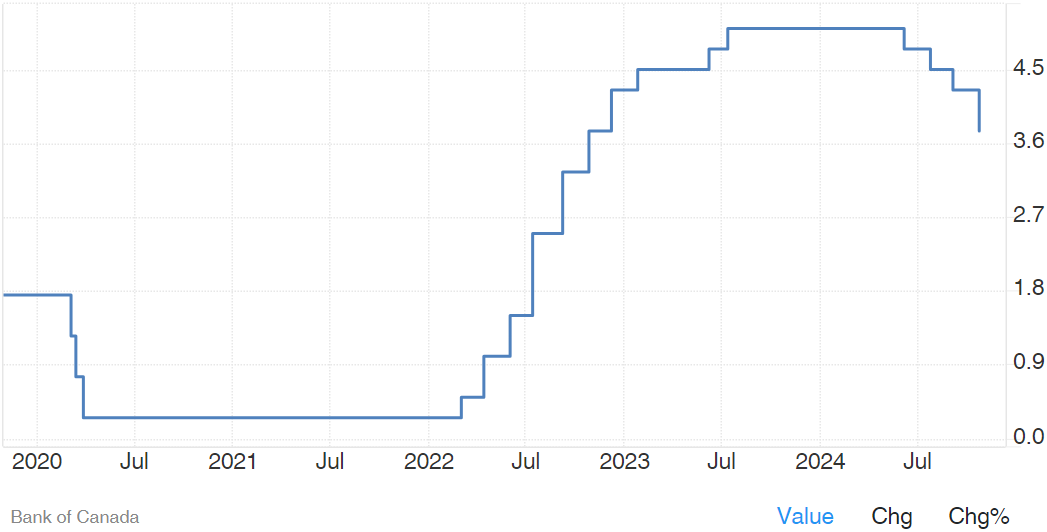

Today, the Bank of Canada announced a significant 50 basis point reduction in interest rates, bringing the benchmark rate down to 3.75%. This move is set to have profound implications for both the Canadian economy and the commercial real estate sector. Let’s explore what this means for consumers, businesses, and investors.

Boosting Economic Activity

One of the most immediate effects of lower interest rates is the increased accessibility to borrowing. With loans becoming cheaper, both consumers and businesses are likely to ramp up their spending. For consumers, financing large purchases like homes and cars becomes more affordable, which can lead to a surge in demand for goods and services. This uptick in consumer spending is crucial for driving economic growth, particularly in a climate where many are looking for ways to stimulate activity. For businesses, the incentive to invest in expansion projects or new technologies becomes more compelling. With lower financing costs, we can expect a rise in capital investments, potentially leading to job creation and enhanced productivity across various sectors.

Commercial Real Estate: A Promising Landscape

The commercial real estate market stands to benefit significantly from this rate cut. Lower financing costs mean that developers and investors can access capital more easily, which can lead to new projects and renovations. This surge in demand for commercial properties—whether office spaces, retail locations, or industrial facilities—could result in rising property values and rental rates. Furthermore, as bond yields decrease, investors may shift their focus toward commercial real estate for better returns. This could create upward pressure on property prices, especially in desirable markets where demand outstrips supply.

Refinancing Opportunities

Existing property owners will also have a chance to take advantage of the lower rates through refinancing. This can improve cash flow and free up capital for additional investments, creating a ripple effect in the market. The potential for refinancing could further stimulate growth within the sector as owners capitalize on favorable financing conditions.

Benchmark Interest Rate (Bank of Canada, BOC)

The Bank of Canada's decision to lower interest rates by 50 basis points to 3.75% is a pivotal moment for the Canadian economy and commercial real estate sector. By making borrowing more accessible, it paves the way for increased consumer spending, business investment, and opportunities in the real estate market. As we move forward, the challenge will be to harness this potential while managing the associated risks. The coming months will be crucial in determining how effectively this rate cut can translate into sustainable economic growth.